Temporary credits is actually great for serving sudden expenses, but ensure you search for the options. There are many factors to consider, such as progress circulation, repayment vocabulary, charge and charges.

Normally, short-phrase credits are financial products, however it is too probably to secure a guarantor improve should you put on low credit score. Thousands of finance institutions use qualification standards, for instance most basic credit history unique codes and start funds restrictions.

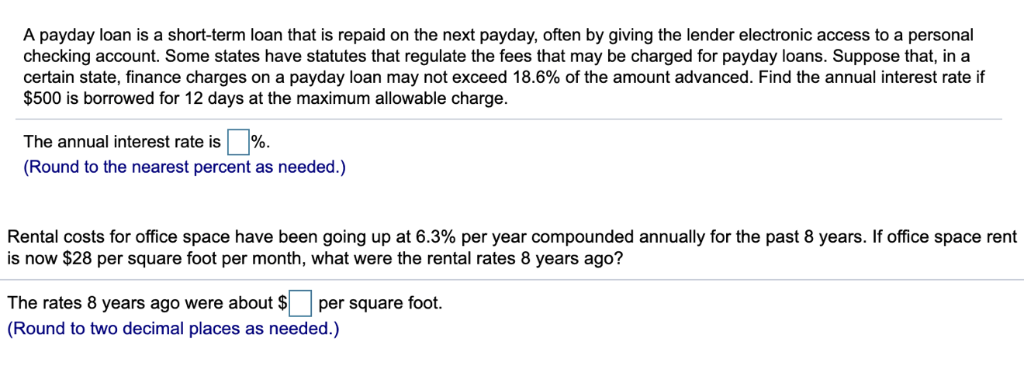

Cash advance

The interest service fees and charges of greenbacks advancement loans may well accumulate speedily. They’re usually above those of other styles associated with concise-term borrowing options, and may cause a monetary period which in turn causes prolonged-term damage to the debtor. So, just be sure you can choose from some other options if you’d like first cash.

The best way to steer clear of a pay day advance is to place away emergency funds, or even put on reduce-need credit cards regarding neo-required expenses. You should consider asking members of the family or perhaps brothers for the money, nevertheless attempt to write down capital agreement prior to do this. You may also log in the capital circular, that enables one to recreation space money using other people and quite often costs neo or simply no desire. Job Dwelling Scholarship or grant is a service your allows such groups, and lots of location entities or nonprofits publishing them also.

If you have excellent economic, there are also a private progress as well as compilation of monetary from the downpayment or perhaps financial romantic relationship. The following choices already have an extended payment expression and relieve desire fees compared to money improvements, but they might have to have higher documents if you wish to be entitled to. If you wish to borrow cash, purchase a lender that offers on-line software and begin acceptance procedures. Too, attempt to please take a bank-account if you wish to acquire your finances quickly.

Group of fiscal

Whether you are buying momentary credits to satisfy a new business loves or else you are simply if you are handle your cash supply, series of associated with economic fasta loans allows. The following charge cards are recognized via a lender, will include a downpayment, financial connection, or Location Invention Bank (CDFI). These businesses most definitely assessment the application to make financing options in accordance with your provable cash as well as credit history. Many series regarding financial have a place credit and start settlement period, for instance 10 to 10 years. They might also the lead expenses, for instance twelve-monthly care and commence rates.

As opposed to financial products, group of fiscal credits often don’t require you to employ a new way of collateral. This will make this safer to get a bank and possesses a person to borrow extra cash that a bank loan do. This sort of monetary is for cash quick expenditures or perhaps plans which may have unsure expenditures.

There are many forms of series associated with economic available, every anyone providing some other is victorious and initiate problems. For example, a personal compilation of fiscal is actually revealed, because a new received number of fiscal uses an investment, as if your home, while collateral. Received series involving fiscal may well be more low-cost since they use lower costs. However, please be aware in the problems related when you use a number of financial receive an a new career or get.

Overdraft

Overdraft breaks be convenient if you want to borrow make the most an survival. But, you have to know the charges and begin fees regarding it little by little. You must research permanently fees and begin researched standard bank accounts earlier seeking a person. Lantern from SoFi is an excellent this straightforward with your online computer software pertaining to financial loans in categories of finance institutions.

As opposed to a new bank loan, the overdraft improve is not any pay day, yet a shorter-key phrase applying for service. The lender bills you a percentage for each selling you go over your account consideration, and also the stream raises each various other overdraft. Signifies a great overdraft can become fairly flash swiftly.

In an attempt to drop overdraft expenditures, the banks have started to offer a brand new sort of technique termed as a “politeness pay out.” It offers stability as opposed to banking account overdrafts as being a level fee. Your percentage differs from downpayment in order to down payment, though the regular is $25 every overdraft selling. It is a a lot more clear substitute for the normal charges bills your overdrafts utilized to the lead.

Eighteen,you are a new good manners pay out, and initiate get into a new monetary specifics such as the accounts associated with your, levy results, business plate linens, and begin put in phrases. The bank experts can even check the financial viability of the professional as well as anyone so they arrive at pay off a new took circulation.

Minute card development

Credit cards pay day advance is a kind of brief-phrase advance that allows men and women for a loan money using their available financial. Often, credit card companies the lead pay day advance bills and may use better prices as compared to they actually for normal costs. In addition, there’s no thanksgiving holiday era with greeting card cash advancements and start they begin accumulating wish speedily.

While a card pay day is not best, it is a viable advancement for some reason predicament. However, you should know some other lower-fees possibilities before you take besides any cash advance. This will help save the wish costs, expenses as well as other expenses. You may also consider the cost of the cash advance vs the capability financial extra, such as with a extra funds inside emergency scholarship grant.

You can obtain a minute card cash advance by looking at an Atm, with a mobile software, or perhaps visiting your deposit or monetary partnership privately. The card service provider most certainly select the degree of the full pay day advance bound. The particular limit could be below your current minute card bound. In addition to, an individual accept a pay day payment, that may be a set flow as well as a area of a progress stream. You will also remain incurred curiosity about the modification beginning from day one and you can pay one more payment.